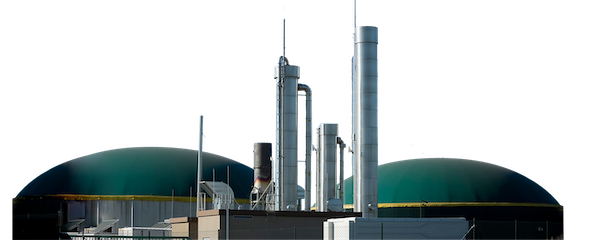

Biomethane, often referred to as renewable natural gas or green gas, plays an important role in the European energy landscape. This gas is produced through the process of anaerobic fermentation of organic materials. This can be plant residues, liquid manure, dung, agricultural waste, food waste or sewage sludge. Biomethane is a promising solution for a sustainable energy supply.

The importance of the biomethane market is growing steadily. Especially in countries with strict climate targets and efforts to decarbonize the energy sector. The market is primarily driven by government support measures such as the GHG quota, environmental regulations and the increasing demand for renewable energy sources. Various technologies, such as the methanation of hydrogen in combination with CO2 (power-to-gas), offer further opportunities to produce biomethane efficiently and in line with demand.

Influences on the biomethane price

The price of biomethane is strongly influenced by the political framework conditions. These can be GHG quotas, which promote the use of renewable energies and thus encourage investment in biomethane production.

Biomethane is traded in Germany via direct marketing. This can be done either nationwide by feeding it into the natural gas grid or locally by selling it directly to end consumers via their own filling stations. The attractiveness of this marketing is largely based on the emission rights traded. These result from the saving of greenhouse gases and can lead to additional income.

Biomethane prices reflect these dynamics and can be influenced by subsidy policies, tax benefits and infrastructure development. This makes them a volatile but strategically important element of the energy price landscape.

In summer 2018, the price for the fuel quota was around 150 euros per tonne of CO2 equivalent. The additional revenue from the sale of fuel quotas due to the GHG reduction through biomethane can be calculated using this value.

Three different CO2 prices were relevant in the same year:

- the EEX emissions trading price of EUR 20 per tonne of CO2 equivalent

- the above-mentioned price of the fuel quota

- the penalty payment of 470 euros per tonne of CO2 equivalent in accordance with the Federal Immission Control Act (BImSchG)

In terms of GHG reduction, a distinction is made between three substrate classes for biomethane:

- Biomethane from 100 % waste and residues

- Biomethane from 100 % farm manure (slurry, dung)

- Biomethane from 100 % renewable raw materials (NawaRos)

Production grew slightly in 2018. More than 10 terawatt hours of biomethane were fed into the grid for the first time. This is despite the fact that the construction of new feed-in plants remains at a low level. An oversupply due to the construction of new plants with sales remaining constant has resulted in falling prices. In addition, climatic changes such as the hot summer of 2018 and the resulting crop failures have increased the cost of feedstock and led to lower production in 2019.

Development of demand on the German biomethane market

The German biomethane market is characterized by increasing demand and rising prices for biogas fed into the grid. The introduction of the Renewable Energy Directive II (RED II) and a growing interest in bio-LNG and, in some cases, bio-CNG, have boosted demand and thus also prices for biomethane, particularly from manure and advanced residues. These sources are particularly profitable due to their more favorable GHG profile and the possibility of double counting as part of the GHG quota. This opens up new business opportunities for biogas plant operators beyond electricity generation under the EEG.

From January 2022, the biomethane price from manure will increase on the basis of a GHG value of -100 g CO2eq/MJ achievable through RED II. The price already includes the possibility of double counting for advanced biomethane. The price applies to a 7-year supply contract starting in January 2025.

External influences that shape the biomethane price

The war in Ukraine has further accelerated the rise in energy costs, including biomethane. However, depending on the energy source, costs rose by up to 80 percent between January and March 2022. This has led to significant cost burdens that hit low-income households particularly hard. Uncertainty on the markets and the freezing of business with Russia by international oil companies have led to record prices for energy products. Russian oil is being shunned and freight rates have risen sharply. In the case of gas, the price increase is caused by high demand and at the same time uncertain supplies from Russia. These general trends in the energy sector were also reflected in the biomethane market. For example, prices for biomethane from farm manure reached a high of 38 ct/kWh in October 2022.

The price of biomethane produced from advanced residues is influenced by the implementation of the Renewable Energy Directive II (RED II). This directive sets a realistic greenhouse gas reduction value (GHG value) of +10 grams of CO2 equivalent per megajoule (gr CO2eq/MJ). The price for biomethane in a six-year supply contract was around 15-16 ct/kWh in January 2025 and rose to up to 20 ct/kWh in October 2023. In addition, the possibility of double counting of advanced biomethane is included in the price. This double counting makes it possible for certain types of biomethane produced from residues to be counted twice under RED II for the fulfillment of GHG quotas. This increases the value of biomethane under such contracts.

Price development of NawaRo biomethane

NawaRo biomethane, which is primarily used in biomethane cogeneration plants (CHPs) that receive remuneration under the German Renewable Energy Sources Act (EEG), shows a specific price trend.

Prices may vary depending on the respective EEG regulations and possible bonuses. Historical data shows that the price for NawaRo biomethane was 12 cents per kilowatt hour in January 2022 and had fallen to 10 cents per kilowatt hour by October 2023. During this period, the price trend was linear with a slight downward trend. There were price peaks of up to 13 cents per kilowatt hour in June and July 2023 and in December 2023. This presentation is based on a hypothetical six-year supply contract starting in January 2025 and reflects the potential price movements based on the historical data provided and the legal framework.

Current price development of biomethane

You can find the exact and current price development at any time on the website at:

Biomethane

Price development

A new milestone was reached in 2022 with biomethane sales of over 11 terawatt hours. Driven by demand in the fuel sector and 6% growth in trading volumes, boosted by rising natural gas prices and the expansion of supply sources, such as from Poland, the Czech Republic, France and Spain. Despite increasing international trading activities, the potential is dampened by inconsistent sustainability requirements and administrative burdens within the EU.

The industry is experiencing an all-time high due to the positive development in the fuel and heating market as well as increasing international trading activities. The expectation of a further increase in CO2 pricing is boosting the competitiveness of biomethane. The European market could continue to experience growth thanks to stable biomethane markets and supporting measures such as RED III and the REPowerEU package.

The GHG quota in Germany, introduced in 2015, will be gradually increased to 25 % in 2030. Between 2015 and 2019, the amount of biomethane included in the quota remained stable, but then increased significantly. In 2021, it was almost 1000 GWh and a further increase is expected for 2022.

The greenhouse gas reduction quota for renewable energies in Germany

The greenhouse gas reduction quota (GHG quota) in Germany is a legally standardized instrument. It has been in place since 2015 and promotes the use of renewable energies in the transport sector in order to reduce greenhouse gas emissions.

On May 20, 2021, this quota was revised and will increase from 6 percent in 2021 to 25 percent by 2030. Biomethane produced from liquid manure, straw and biowaste is particularly effective in reducing greenhouse gas emissions and achieves savings of up to 60 % compared to a mid-range diesel car purchased in 2019.

GHG quota for biomethane

The GHG quota expresses as a percentage how much sustainable fuel is used in relation to the total amount of fuels, including fossil fuels such as diesel and petrol. For 2021, the GHG quota was set at 7 %. Operators of biogas plants form an important source of income by selling the GHG quota when using biomethane as a fuel, whereby they can calculate the savings individually.

This regulation promotes the use of biomethane and other sustainable fuels by offering economic incentives for the reduction of greenhouse gases. By increasing the quota, a stronger incentive is created to increase the share of renewable energies in the transport sector.

High quota prices were reported for 2022, which are expected to continue in the coming years. This is due to the penalty payment for non-compliance. Further development potential is seen for biomethane, particularly in the CNG and LNG fuel sector. Although the use of CNG in passenger cars is decreasing, CNG trucks and especially LNG trucks are still in demand. The toll exemption for CNG and LNG trucks has been extended until 2023, resulting in additional demand. However, uncertainties are dampening the extension of the current growth trend, for example due to the discussion about the elimination of double counting of advanced biomethane.

Introduction of the EU-wide Union database

The introduction of an EU-wide Union database will also affect imported biomethane. This development could result in greater competition and increased trading activity. In addition, the scandal surrounding misdeclared biodiesel from China affected the biomethane price between March and October 2023.

After all, the German mineral oil industry exceeded the GHG quota in 2021 and saved over 15 million tons of CO2 in the process. This exceeds the legal requirements and biomethane has played a significant role in this.