Introduction:

Whether climate change, security of supply or biodiversity. The agricultural sector is characterized by constant change and faces an increasing number of new problems that must be overcome.

As a result, there are both challenges from more and more regulations and many new opportunities from new business ideas.

Many of these business ideas are primarily concerned with sustainability. As a logical consequence, more and more impact investors are entering the agricultural sector.

Impact Investing:

Impact investing is a relatively new way of investing, often in line with the UN Sustainable Development Goals stands. In addition to the sustainability concept, impact investing is also about generating an economic return. First and foremost, it is important that a sustainable impact can actually be measured.

Possibilities to measure the impact in key figures would be e.g. a mapping of the CO2-emissions, or the extent to which the business model reduces them. Furthermore, certified ESG ratings and indices are suitable for measuring the positive impact.

However, since many smaller or young companies do not have the financial or bureaucratic means to cope with such templates, a transparent business model based on the UN Sustainable Development Goals seems to make sense at first glance.

Impact investors are mostly asset management companies, insurance companies, pension funds, banks, but also private individuals. The reasons for impact investing are changing customer needs of the investors or the solution of social problems without achieving a maximum return.

The UN Sustainable Development Goals:

The UN Sustainable Development Goals were adopted in 2015 as "AGENDA 2030". The global community has committed itself to these goals for a better future. These include environmental, social and economic aspects (Figure 1).

Why is impact investing interesting?

Although impact investing is a younger sector, it is growing strongly and enjoys social tailwind. Reasons for further growth of the sector include internationally rising environmental standards.

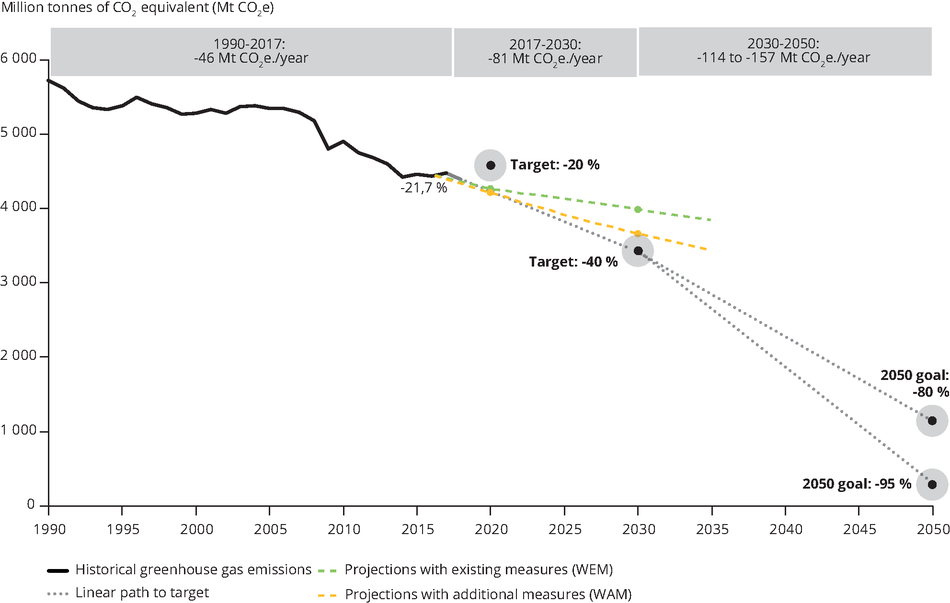

The European Union in particular has set itself particularly ambitious targets by international standards to reduce greenhouse gas emissions. To this end, far-reaching regulatory measures are being introduced that may in turn change the market behavior of companies as well as private consumers.

These measures include, for example, an emissions trading system to make pollution more expensive, an introduction of sustainable fuels, a clean energy system with its own power generation, and the sustainable refurbishment of existing buildings.

These market changes alone could make the economics of impact investing even more attractive in the future.

The EU with particularly ambitious climate targets:

The EU has significantly exceeded its 2020 emissions reduction target of 20 %. According to recent estimates, greenhouse gas (GHG) emissions in EU member states in 2020 were 32 % lower than in 1990 (chart 2). Nevertheless, EU member states still need to make significantly greater efforts if the net reduction of 55% in 2030 is to be achieved. In addition, in 2020, the COVID-19 pandemic led to the high GHG reduction as a special effect.

The reasons for the long-term GHG reduction are an interplay of structural macroeconomic changes and a particular focus on sustainable energy production.

Europe as a Drawcard for Impact Investing:

Internationally, Europe performs particularly well as an investment location for impact investing, according to investor surveys. As shown in Chart Three, the fastest-growing regions were Western, Northern and Southern Europe (WNS Europe) and East and Southeast Asia (SE Asia), which saw 25% and 23% average annual growth, respectively, from 2015 to 2019.

The agricultural sector compared to other sectors in impact investing:

While the WASH sector with water, sanitation and hygiene supply has grown the most, the agricultural sector also plays a not insignificant role (chart 4). In the latter, investments increased by an average of 22% between 2015 and 2019.

Food and agriculture, while accounting for a relatively small share of assets under management (9 % with no outliers), has some allocation to the sector with 57 % of respondents and the highest share of respondents (54 %) planning to increase their allocations over the next five years (2020 Annual Impact Investor Survey).

Examples of impact startups from the agricultural sector in Germany:

Climate

Klim offers a digital platform that shows farmers regenerative documentation and financing options. The focus is on regenerative agriculture. For example, methods are used where the soil draws more CO2 from the atmosphere than it releases. This results in positive side effects such as increasing yields and more resilient soil. Overall, this makes agriculture more climate-neutral. Thus, there is a special focus on goal "13" (Climate Action) of the UN Sustainable Development Goals.

Various impact investors, such as the Green Generation Fund or WI Venture, decided to invest in the young company Klim in financing rounds in recent years.

skyseed

Skyseed enables forest reforestation with the support of drones and pelleted seeds. This is a way of achieving sustainable CO2-storage is possible. First, the young company conducts an analysis of the current situation, and then, in the next step, transports the pelletized seed to the right places. As with Klim, Skyseed's focus is on goal "13" (Climate Action) of the UN Sustainable Development Goals.

In addition, skyseed also enjoyed fresh capital from impact investors with participation by WI Venture and Better Ventures.

agriportance as an impact start-up:

In addition to Klim and Skyseed, agriportance also focuses on various sustainability goals. These are primarily goals "seven" (Affordabe and Clean Energy), "eight" (Decent Work and Economic Growth), "nine" (Industry, Innovation and Infrastructure) and "13" (Climate Action).

With the current media situation leading to more and more calls for independence from foreign gas supplies, biomethane offers a real local alternative. Due to the generally strong increase in gas prices, the green alternative biomethane is gaining competitiveness.

agriportance wants to make the biomethane market more efficient by helping biomethane producers to cope with the bureaucratic and complex greenhouse gas balance and to find a buyer for the produced quantities. At the same time, oil companies will be supported in finding the right producer in the highly fragmented market with approximately 9,500 biogas and biomethane plants in Germany.

The objectives can be found in agriportance's business model. In this context, biomethane is particularly suitable as alternative energy source. It is virtually climate-neutral, as it 85% emits fewer Co2 emissions than the fossil alternative natural gas. It is also particularly attractive for use in heavy-duty transport. There are already around 900 CNG and more than 100 LNG filling stations in Germany. The 9,500 biogas plants are looking for alternatives as the EEG subsidy expires. In this context, a conversion to biomethane can economically promising be

Summary and outlook:

In the future, impact investing will continue to play an important role in the agricultural sector, both due to social will and political changes. This opens up many opportunities for investors as well as companies to adapt to the changing sector in time. agriportance also makes an ecologically, socially and economically sustainable contribution.