Why the German biomethane market is so interesting: an in-depth look

The biomethane market has caused quite a stir in recent months. With rapid price jumps, intense discussions around the greenhouse gas (GHG) quota under the Renewable Energy Directive (RED) III, and a general upswing in the industry due to the energy crisis, it is clear that the German biomethane market is more exciting than ever. But what makes it so attractive? And what circumstances characterize the German market in particular?

A dynamic market picture: biomethane revenue through the greenhouse gas quota

According to dena's "Biomethane 2023 Industry Barometer" analysis, total biomethane sales exceeded the 11-TWh mark for the first time in 2022. A main driver of this development is the growing demand for biomethane in the fuel sector. Here, one also sees increased import and export activities. A particular incentive for EU member states is that biomethane produced in other EU countries can count towards the German greenhouse gas quota (GHG quota).

What are the benefits of the German greenhouse gas (GHG) quota?

The greenhouse gas quota (GHG quota) in Germany characterizes the legally prescribed reduction of greenhouse gas emissions. Quota obligated parties - usually mineral oil companies - must meet this by introducing sustainable biofuels to the market. The reference base for the reduction is diesel's reference value of 94.1 g CO2 equivalent per megajoule. Instead of focusing solely on the energetic quantity of biofuels provided, as was previously the case with the biofuel quota, the focus is now on the actual reduction of greenhouse gas emissions.

This reorientation arose from the need to steer the use of biofuels more strongly in the direction of reducing greenhouse gas emissions. In 2015, the GHG quota thus replaced the biofuel quota. With this innovation, the German Bundestag limits emissions from the petroleum industry. In addition to the direct blending of biofuels, the trading of quotas based on the production of biomethane gives mineral oil companies another option for reducing their CO2 emissions.

Biomethane producers play a key role here. They produce the gas, which serves as a fuel and thus indirectly saves CO2 emissions. The resulting GHG quota is either sold directly to the obligated companies if the producers also act as distributors of the biomethane, or they sell the biomethane to other distributors. The placing on the market or refueling of the biomethane generates the said quota. The revenue generated is based on the sale of these quotas to the obligated companies.

This switch from biofuel quota to GHG quota is based on the European Renewable Energy Directive (RED II). The original 2009 Renewable Energy Directive (RED) and its 2018 revision (RED II) set renewable energy targets for the transport sector. These define criteria for sustainability and greenhouse gas savings. In parallel, the Fuel Quality Directive (FQD) was established, which aims to reduce life-cycle emissions from fuels. EU member states are required to transpose these directives into national law. In Germany, this resulted in their integration into the Federal Immission Control Act (BImSchG) and the Biofuel Sustainability Ordinance (Biokraft-NachV).

What circumstances make Germany an attractive biomethane market?

The GHG quota in Germany was introduced to create an incentive for the market, especially for biofuels with high GHG reductions. While fossil natural gas cannot contribute to meeting this quota, biomethane does. Interestingly, the eligibility of biomethane for this quota depends on the substrate used. A prominent candidate in this area is biomethane produced from farm manure, such as slurry. This is classified as an advanced biofuel.

In fact, companies that exceed their quota obligation benefit twice, as surpluses of advanced biofuels can be counted twice toward the overall GHG quota. In contrast, companies that fail to meet or miss their quota face financial penalties. These penalties were set at 0.47 euros per kg CO2eq until the 2021 commitment year and were increased to 0.60 euros per kg CO2eq from 2022.

These regulations have led to an increased demand for biomethane, which in turn has influenced the prices and revenue potentials for biomethane in Germany. However, the requirements and thus the revenue potentials for biomethane vary depending on the substrate group used. The EU has recognized that the production of conventional biofuels can have negative impacts, for example by affecting areas with high biodiversity. Therefore, EU member states have been given guidelines that promote the use of biofuels, but under strict sustainability criteria.

Why is biomethane from farmyard manure important for the German biomethane market for Fuele so attractive?

Particular attention is paid to biomethane from manure, taking into account the "manure bonus". This bonus results in GHG emission reductions at an impressive default value of -100 g CO2 eq/MJ, as specified in RED II. In fact, when calculated individually, this value can even be exceeded. Therefore, the prices and revenue opportunities for biomethane in Germany are closely linked to the substrate used and the associated GHG ratio.

Within the greenhouse gas quota (GHG quota) system, farm manure and advanced residues will enjoy double crediting in the coming years. This gives them a more advantageous GHG value compared to renewable resources (NawaRos). What this means for you is that biomethane produced from farm manure and advanced residues offers the highest revenue opportunities. The reason is that the GHG value is the central element for pricing and depending on which substrate is used, different premiums or discounts are applied to the price.

What does the price development for biomethane look like?

The long-term marketing of biomethane opens up considerable revenue prospects, especially when considering that a stable and sustainable source of revenue can be generated by concluding 7-year supply contracts with biomethane customers. Detailed insights into which specific revenue opportunities arise depending on the substrate used can be found on the website: Learn more about biomethane prices and revenue opportunities here.

However, it is equally important to keep your eyes open for short-term opportunities - this is where the spot market plays a crucial role. On this market, natural gas and electricity are traded in near real time, which means that supply and demand meet directly. Trades made here reflect the current market price and are concluded within two days. Accordingly, biomethane trading is based on the current exchange price, which certainly offers lucrative opportunities for higher revenues.

However, one should not focus solely on the price development. Global trends in biomethane demand and supply are also relevant. A growing media interest in bio-LNG and also bio-CNG testifies to an increasing awareness and interest in sustainable energy sources. In addition, biomethane production offers new business opportunities for biogas plant operators that go beyond the previous possibilities offered by the EEG. So it is an exciting time for all those who want to get involved in the biomethane sector.

So what are the key factors for revenue on the German biomethane market?

Accordingly, the central factors on the biomethane market can be summarized as:

- The GHG quota: it ensures that companies favor advanced biofuels, which increases biomethane prices in Germany and the associated revenue opportunities.

- Differentiated substrate categories: Biomethane can be credited differently depending on the substrates used. Biomethane from farm manure and advanced residues offers the best revenue opportunities, as the GHG value is the pricing element.

- Long-term marketing opportunities: With 7-year supply contracts, biogas producers can secure stable sources of income.

- The spot market: A look at the spot market shows that biomethane is traded at the current exchange price, which offers additional revenue opportunities.

In addition to the domestic biomethane market, international trade also plays a significant role. The growing interest in Bio-LNG and Bio-CNG offers new opportunities also for biogas plant operators from other EU member states.

What does the international trade of biomethane look like? Keyword: Demand and need

Demand and interest in the biomethane market have grown noticeably as a result of the energy crisis and the resulting increase in natural gas prices. Caused by high gas prices and mechanisms such as the EU Emissions Trading Scheme (EU-ETS) and the Federal Emissions Trading Act (BEHG), international trade in biomethane has increased sharply. Data from dena in 2022 show that 3.5 TWh of biomethane certificates of origin were transferred from neighboring European countries to Germany. One of the reasons for this is that biomethane - whether as Bio-CNG or BIO-LNG - from other EU countries contributes positively to the German GHG quota.

Sources of supply for biomethane has expanded

The range of supply sources for biomethane has consequently expanded. Exports from countries such as Poland, the Czech Republic, Spain and also France are particularly relevant here. As expected, France will start exporting guarantees of origin in January 2024, bringing further volumes of biomethane to the market. Furthermore, Denmark is a key player. There, biogas already accounts for 30 percent of the total gas market. Until now, the use of this biogas has primarily taken place in Sweden. However, a recent ruling by the European Court of Justice could affect this export route, opening up new opportunities for countries like Germany.

The outlook for the European biomethane market is positive. More stable markets are emerging as a result of planned biomethane plants and EU-level measures, especially the RED III Directive. In addition, the establishment of a European Union database promotes trade between EU member states.

However, there are also hurdles. The different sustainability criteria of the EU member states and the associated bureaucratic hurdles make international trade more difficult. For Germany, one thing is clear: Only biofuels that meet the criteria of the Biofuel Sustainability Ordinance (Biokraft-NachV) can contribute to quota fulfillment.

What are the current regulations for the certification of biomethane in the German fuel market?

Until the first financial return from quota trading can be realized, there is an indispensable hurdle to be overcome: certification of the biomethane. Even if biomethane is imported from countries outside the EU, this should not be seen as an obstacle. However, this imported biomethane must meet the same high sustainability standards that apply to biomethane produced in Germany. For the German region, these requirements are specifically set out in the Biofuel Sustainability Ordinance (Biokraft-NachV). Accordingly, biomethane used in the fuel sector is produced either by systems such as. REDcert or ISCC certified.

The certification process itself is not trivial. The plant operator must commission a qualified auditor to check that the sustainability criteria have been met in an in-depth audit. This includes, among other things, verification of greenhouse gas reduction through a corresponding GHG balance, a detailed analysis of the mass balance, and a comprehensive review of all relevant documents that accompany the entire biomethane value chain.

What's the deal with mass balancing of biofuels in the German biomethane market?

There are two main verification systems in the EU member states for biomethane: the "Book and Claim" via Guarantee of Origin (GOs) systems and the mass balance system.

While GOs separate sustainability attributes from the physical commodity, the mass balance system ensures that certified material leaving a supply chain has been added to it in the same quantity. This system requires detailed records of biomethane transport, biomethane conversion processes, and other factors.

In principle, the GO has been expanded to cover not only electricity from renewable sources, but also renewable gases. GOs serve as a means to demonstrate to the end user that a certain percentage of the energy they consume comes from renewable resources. The GO can be transferred regardless of the energy gas unit for which it was originally issued For more information on GOs, see Article 19 of RED II or visit the German Federal Environmental Agency. However, a GO issued for biomethane does not contribute to meeting national renewable energy targets. Therefore, under RED II, the EU has divided biomethane into two groups with two different potential values:

- A renewable fuel for transportation under the mass balance system, with a GHG reduction value for achieving the targets under Article 29 (1); and

- a green added value for energy products under the GO scheme.

Mass balance system on the part of the EU obligatory for the use of biomethane as fuel

The different potential values also make it clear that the mass balance system is mandatory on the part of the EU for the use of biomethane as a fuel in transport. In Germany, the obligation for mass balance is explicitly mentioned in the Biokraft-NachV. In this way, they ensure that the amount of certified material leaving the supply chain is equal to the amount of certified material entering the supply chain, taking into account conversion processes. More details on mass balancing can be found at: >link<

In principle, national regulators can introduce their own mass balance systems by having them validated by the EU. Currently, the European Renewable Gas Registry (ERGAR) has applied for such a validation for the European gas grid. The outcome of this application is still open.

What about after the biomethane is certified?

Once certification has been successfully completed, the operator of biomethane plants can open an account in the Sustainable Biomass System (Nabisy) at the Federal Agency for Agriculture and Food (BLE). There, the freshly obtained certificate and the respective quantities of certified biomethane are deposited. In addition, the specific greenhouse gas emissions of the biofuel in kilograms of carbon dioxide equivalent per megajoule are recorded. After data entry, an official sustainability certificate is issued to the operator. This document, along with the annual quota declaration, must be submitted to the biofuel quota office. You can see what a sustainability certificate looks like in the figure below. It becomes clear in view of the certificate how important the mass balance system is for participation in the German biomethane market as well as the relevance of the specific greenhouse gas emissions.

Figure 1: Example of sustainability proof

With regard to the quality of the biofuel, further proof is required, often in the form of certificates of analysis or manufacturer declarations. With the approval of the biofuel quota office, alternative suitable forms of proof can also be accepted. As of January 1, 2017, the sustainability certificate or partial certificate under the Biofuel Sustainability Ordinance (Biokraft-NachV) are considered formal producer declarations. It should be noted that the biofuel quota office may also require samples that must comply with certain minimum standards. These standards are defined in the DIN EN 16723-2:2017-10 standard, which describes the specifications for natural gas and biomethane in the transport sector and for biomethane for injection into the natural gas grid.

In summary, both strict certification processes and extensive documentation requirements are necessary for the trade and use of biomethane in Germany. This ensures that the biomethane meets the high requirements for sustainability and quality.

What are the exact biomethane export regulations?

The export of biomethane to Germany represents a rule-bound undertaking characterized by a complex legal situation. In principle, the import of gaseous biomethane from other EU member states into the German public natural gas grid is permitted, provided that all relevant requirements are met. The focus is on the fact that both the injection and the withdrawal or exit of the biomethane take place in the excise tax area of the European Union. Furthermore, it should be noted that the balance sheet allocation of the biomethane is exclusively limited to the excise tax territory of the European Union in accordance with the EU directives.

Which laws and regulations exist for the import of biomethane to Germany

A key criterion here is that the imported biomethane is used as a fuel on the German market. In addition, it must be ensured that the biomass used to produce the biomethane qualifies for the credit. Correct taxation represents another fundamental condition for the biomethane to count toward the greenhouse gas (GHG) quota in Germany. Not only biomethane from other EU countries is eligible, but also physical biofuel that is physically imported into Germany regardless of where it is produced can contribute to meeting the GHG quota.

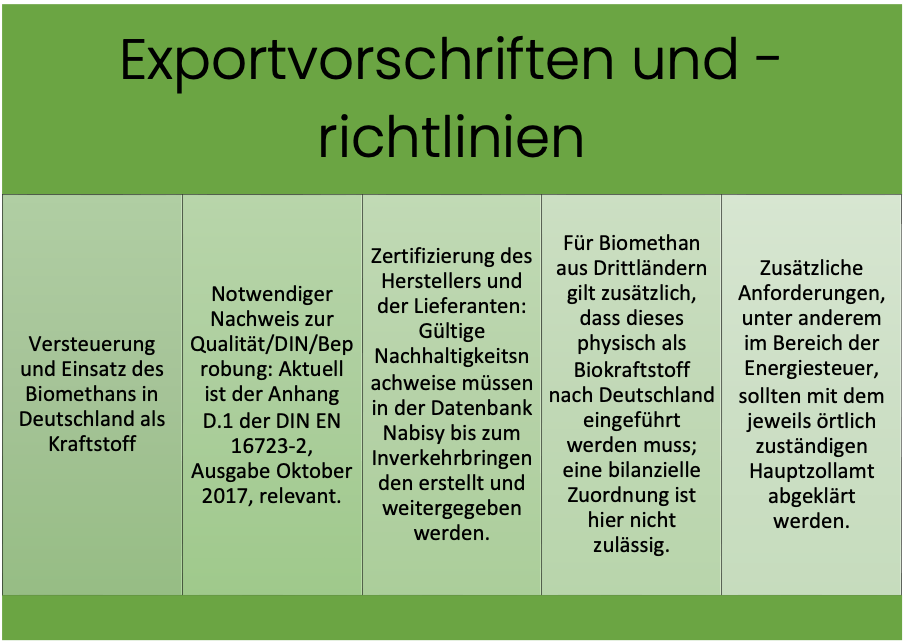

Biomethane exported from countries outside the EU, so-called third countries, is a separate regulation. Here, the biomethane must be in physical form; an accounting allocation is not permitted in this context. If you are considering biomethane products, whether in gaseous form (Bio-CNG) or in liquefied form (Bio-LNG), from other EU countries, you should find out about the specific requirements. The main customs office provides detailed information for the biomethane market on the conditions that must be met in order for such products to count toward the German GHG quota. For a more comprehensive and clear overview, these criteria are detailed in the figure below.

Figure 2: Export regulations and guidelines for biomethane import.

If you need more, you can find information on the website of the main customs office under the keyword "greenhouse gas quota" or you can contact us.

The international trade opportunities of biomethane between Germany and other countries - whether EU member states or third countries - vary depending on the existing legal regulations and bilateral agreements.

What are the possibilities for international trade of biomethane between Germany and other EU member states or non-EU member states?

Within the EU: Biomethane trade with EU member states is possible under certain conditions and taking into account sustainability requirements. This allows the free trade of biomethane via the public natural gas network. It must be ensured that imported biomethane meets the same sustainability requirements as biomethane produced in Germany and that the above-mentioned export regulations and guidelines are observed.

Non-EU member states - case of Switzerland: Switzerland, although not a member of the EU, has numerous agreements with the EU that facilitate trade. However, when exporting biomethane from Switzerland to Germany, there are special rules and regulations that must be observed.

Austria and its peculiarities: Austria has its own system for regulating biomethane and its trading in the biomethane market. In Austria, if the producer feeds gas into the public grid and it is withdrawn elsewhere but neither for final consumption nor for conversion purposes, such as when gas is used for transport, the gas certificate of origin (HKN) applies according to §81 Renewable Expansion Act Package (EAG). Specifically, it means that when gas is converted, the certificate of origin is invalidated and green gas certificates are issued instead in accordance with § 86 EAG (exception UBA). Accordingly, the guarantees of origin cannot be removed again. E-Control is the independent electricity and gas regulator in Austria that monitors and supervises the energy markets. In concrete terms, however, you should first note that biomethane exports from Austria do not proceed without further ado and that many individual regulations have to be considered

It is important to emphasize that despite the possibility of trading biomethane on an international level, compliance with sustainability criteria, legal requirements and bilateral agreements must always be ensured.

The German biomethane market - an outlook

The German biomethane market is at the center of a dynamic development, driven by regulatory incentives, market mechanisms and international trends. For players, it thus offers multiple opportunities with regard to biomethane export to Germany and revenue opportunities on the German fuel biomethane market. To easily overcome the challenges of certification for biomethane export to Germany, you can simply contact us.