The price composition of biomethane as a biofuel is a multi-layered process that is influenced by various cost factors. These factors include production costs, transportation costs, taxes and levies as well as profit margins. Each of these cost points plays a decisive role in determining the final price of biomethane for the consumer and the profitability for the producer and supplier.

Production costs from biomethane

The production of biomethane is a complex process that involves the fermentation of organic materials such as agricultural waste, liquid manure or energy crops. The costs of the raw materials, the fermentation technology, the processing of the gas produced and the costs of operating and maintaining the plants must be taken into account here. Operating costs also include expenses for energy, water, personnel and plant maintenance. Increases in efficiency and technological advances can reduce production costs, but the investment costs for the construction of the plants remain a significant factor.

Determining the sales prices for biomethane from manure in the fuel sector requires a detailed examination of the cost structure. This is done along the entire value chain as well as an analysis of profitability. Several defined factors form the basis for determining costs:

- The biomethane has a greenhouse gas (GHG) saving of -100g CO2eq.

- Existence of a biogas plant; only the construction of a biogas upgrading plant is required.

- The distance to the natural gas grid is less than 1 kilometer.

- 100% of the capital employed consists of borrowed capital.

- production of raw biogas is 250 standard cubic meters per hour; biomethane production is around 125 standard cubic meters per hour.

- The biogas plant has already been fully depreciated.

Cost components incurred in the production of biomethane

Various investment costs must be taken into account for the conversion of biogas to biomethane:

- Fixed costs for the biomethane processing plant amount to 1.5 million euros.

- A central pumping station with a pumping capacity of 85 cubic meters per hour incurs costs of 50,000 euros.

- Expenditure of 20,000 euros is incurred for the pump enclosure.

- A biogas feed-in system costs 250,000 euros.

Planning, approval and other items such as certification are estimated at a flat rate of 10% of the total investment. Depreciation for the technical equipment is set for 10 years, resulting in annual fixed costs of around EUR 200,000. The variable costs vary depending on the operation. A significant cost factor is the purchase of substrate, which can have a considerable impact on profitability.

Example calculation of the production costs of biomethane

In our scenario, we assume a substrate input of 20% maize silage and 80% liquid manure. The variable costs are made up as follows:

- The production of maize silage costs 45 euros per ton.

- The trade tariff catalog (HTK) for additional purchases is 50 euros per ton.

- A flat rate of 10 euros per ton is assumed for the disposal of the digestate.

- The provision of heat for the fermenter incurs costs of around 50,000 euros per year.

- Repairs, maintenance and operating materials cost around 180,000 euros a year.

Between June and October 2022, a biomethane price of around 22 cents per kilowatt hour was achieved on the spot market. Long-term contracts achieved lower prices in some cases due to double marketing. Assuming a cautious price of 20 cents per kilowatt hour for biomethane with a GHG value of -100g CO2eq and taking into account avoided grid fees of around EUR 50,000, an annual turnover of around EUR 1,800,000 could be achieved. After deducting fixed and variable costs, this resulted in a profit of around 650,000 euros per year. With this constellation, a system could pay for itself within three years.

For many stakeholders, trading GHG quotas now represents a significant economic incentive for the transition to sustainable energy in the transport sector. Be it by maintaining existing vehicle fleets or switching to electric drives. However, the statutory increases in the GHG quota to 9.25 percent in 2024 and the following years are not sufficient to achieve the climate protection targets in the transport sector by 2030.

Factors that determine the biomethane price

Transportation costs

After production, biomethane must be transported to the distribution points or directly to the end customer. This logistics chain can include costs for transportation by truck, feeding into the gas grid or transport by ship or rail. The costs vary depending on the distance, means of transportation and infrastructure.

Taxes and duties

In Germany, the sale of biomethane is subject to energy tax, although biofuels can be tax-privileged under certain conditions. Further charges may arise due to regulatory requirements, such as emission certificates. These costs are usually passed on to the final price. They contribute to the total amount that the consumer has to pay.

Profit margins

Producers and suppliers of biomethane calculate profit margins in order to amortize their investments and generate a profit. These margins must be competitive and depend on various factors. Including market dynamics, competition from other biofuels and consumer demand.

The Obligation to reduce emissions in Germany

The legal obligation to reduce emissions in Germany creates a market for trading GHG quotas, which makes the use of biofuels such as biomethane more attractive. Oil companies that place fossil fuels on the market must reduce their greenhouse gas emissions. The GHG quota, which is defined as a percentage of the total fuel volume, indicates the proportion that must be replaced by sustainable fuels.

Rising GHG quotas increase the demand for biofuels. As distributors of fuels have an incentive to achieve their emission targets by using biofuels instead of risking high penalties. The fixed penalty of €470/t CO2eq for not achieving the GHG quota is a significant economic incentive. This also indirectly influences the pricing of biomethane. If the costs for CO2 reduction when using biomethane are lower than the penalty, it becomes more attractive for oil companies to use biomethane instead of paying the penalty.

The competitiveness of biomethane compared to other biofuels such as biodiesel or bioethanol is ultimately influenced by the price. Manufacturers can charge this for the GHG quota. The production of biomethane has different cost structures compared to other biofuels. This can lead to a diversification of pricing. In addition, regional differences in the availability of raw materials and the efficiency of production processes have a direct influence on prices.

The GHG quota price

The GHG quota price reflects the cost of emitting one tonne of CO2 equivalent and is a key element in the regulation of greenhouse gas emissions. The price fluctuations of the quotas between 430 and 520 euros per tonne of CO2eq in 2021 show the changes in demand for emission allowances. These are influenced by various factors such as market dynamics, political decisions and economic activities.

The GHG value plays a key role, as it determines how much of the so-called quota can be met by using a certain amount of biomethane. Biomethane is considered more environmentally friendly as it releases less CO2 during combustion compared to fossil natural gas. The amount of GHG quotas that can be generated with biomethane depends on its greenhouse gas savings potential.

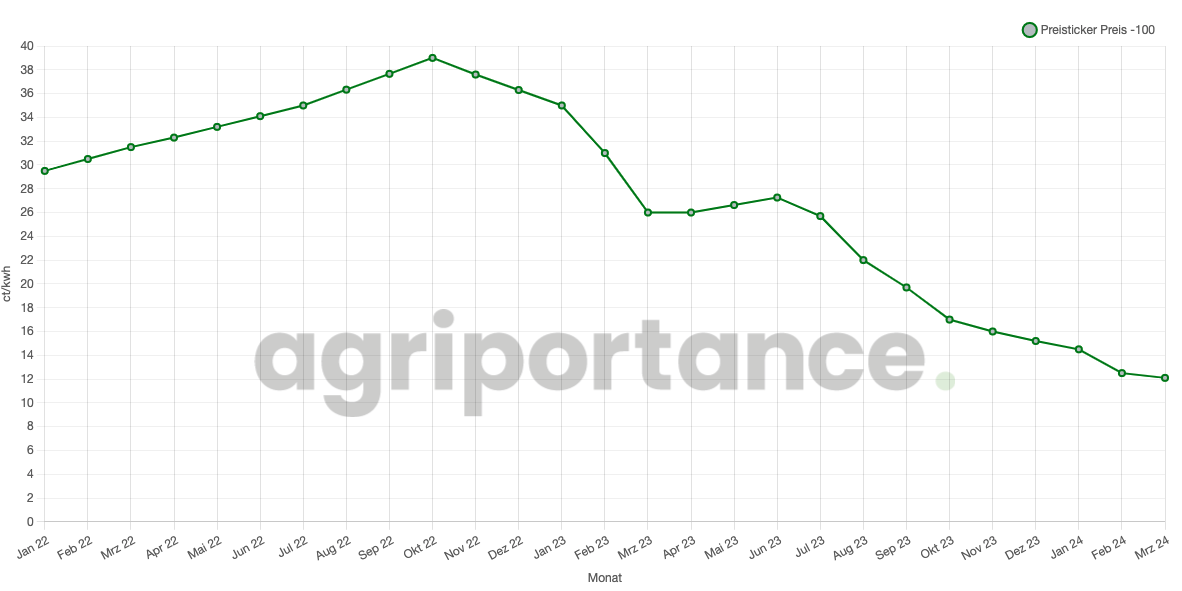

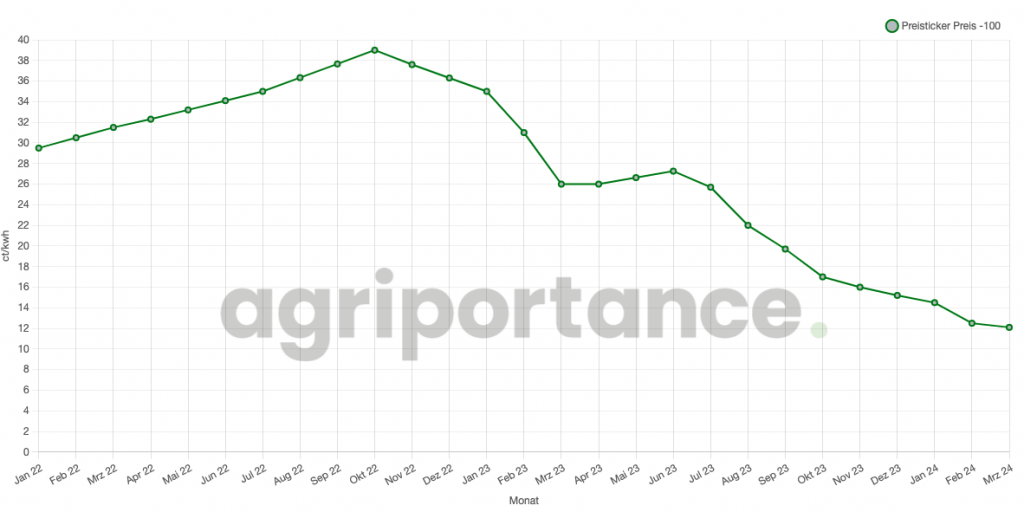

Price development of biomethane

Important sustainability properties of biomethane

As far as sustainability properties are concerned, there are two important points:

- Double counting of savings from advanced raw materials: Once a certain sub-quota has been met, savings from the use of advanced raw materials can be credited twice. This is intended to create an incentive to use more advanced and environmentally friendly raw materials in order to further reduce CO2 emissions.

- Upper limit for NawaRo biomethane: For biomethane produced from renewable raw materials (NawaRo), there is an upper limit for the proportion of plants that could also be used as food or animal feed. This regulation is intended to ensure that the production of biomethane does not compete with food and animal feed production, thereby guaranteeing sustainability.

TTF price

The TTF price refers to the trading market for natural gas in the Netherlands, known as the Title Transfer Facility (TTF). This spot market is one of the most important and liquid trading venues for natural gas in Europe and serves as a benchmark for the pricing of natural gas in the region. The TTF price is used for short-term trading (spot market) as well as for long-term contracts (futures) and reflects supply and demand on the European natural gas market.

Composition of the gas price

The gas price is made up of the following main components:

- Gas prices on the international markets, which can fluctuate depending on supply and demand, geopolitical events and other economic factors.

- The network charges that cover the costs of using the transmission and distribution networks for gas. These fees can vary depending on the region and the costs of maintaining the infrastructure.

- Taxes and levies, including the CO2 price.

These state-defined cost items can include aspects of environmental and energy policy. Examples include the CO2 price, which aims to reduce the emission of greenhouse gases. It does this by putting a price on the carbon content of fossil fuels.

All of these factors combine to shape the final price that consumers pay for gas.

Effects of the TFT price on biomethane

The TTF price as an indicator for natural gas can have an impact on the biomethane price. This is due to the fact that biomethane is seen as a renewable alternative to conventional natural gas. If the TTF price rises, this can make biomethane more competitive, as the price difference between renewable gas and fossil natural gas is reduced. Conversely, a falling TTF price can make biomethane appear more expensive and reduce its competitiveness against natural gas. However, biomethane prices are also dependent on other factors, such as local subsidies, production costs and specific market dynamics.

The natural gas price at the TTF hub (Title Transfer Facility) in euros shows a relatively stable and low price, which rises slowly in the first half of 2021. From May 2021 (May.21), prices start to rise sharply, with notable peaks and high volatility. The extreme peaks, which go well beyond 200%, reach their peak around November 2021 (Nov.21). After these peaks, the price falls, but rises again in May 2022 (May.22). Subsequently, the price falls again and stabilizes at a higher level than at the beginning of the period shown, with a final value of around +208% in May 2023 (May.23). You can find more information on current natural gas prices at https://www.finanzen.net/rohstoffe/erdgas-preis-ttf/chart

These volatile movements are due to various market conditions. Examples include changes in demand, political decisions, contractual changes or other external events, such as the war in Ukraine, which influence the natural gas market.

Historical TTF gas prices can be seen as an indicator of general energy market trends, which in turn can influence biomethane prices, especially in markets where biomethane is used as a direct substitute for natural gas. To determine the exact impact of the TTF gas price on the biomethane price, one would need to look at specific market analyses that analyze both natural gas and biomethane prices over the same time period. If you have any questions, please contact us. Contact Henning.

Promotion of biomethane

The promotion of biomethane also creates incentives for more sustainable agriculture. This is achieved by supporting the recycling of organic waste and thus minimizing the ecological impact of agricultural activities. This not only strengthens rural areas, but also supports the energy transition and the circular economy.

In the fuel sector, biomethane as CNG is an environmentally friendly replacement for traditional fossil fuels. The combustion of biomethane in vehicles leads to lower emissions of nitrogen oxides (NOx) and particulates. Which in turn improves air quality and reduces greenhouse gas emissions. Governments and authorities are motivating the switch to biomethane through financial incentives, tax breaks and support programs.

CNG filling station infrastructure

A decisive factor for the success of biomethane as a fuel is the availability of a corresponding infrastructure for CNG filling stations. While some countries already have a well-developed network, others still have a lot of catching up to do.

To summarize, the price composition of biomethane is determined by a complex mix of production costs, transport and logistics costs, tax conditions, market dynamics and government requirements to reduce emissions. Profit margins must be carefully calculated. This in order to be able to compete, while at the same time the legal framework for reducing emissions provides an additional financial incentive that influences demand and therefore also the price of biomethane.